Get Your Application Approved - Part 1

Congratulations!

You've just completed and submitted your application for term life insurance. And now you wait to hear if you have been approved for coverage. Just as with anything in our lives, acceptance makes us feel we are part of something, having more value. Rejection hurts.

While you are waiting, you begin to wonder if anything could go wrong: Did the agent get all the information and submit to the insurer in good order? Delays and more waiting will result from an application missing information. Did you forget something that might have an impact on the insurer's decision? Results of that medical exam you had to take could show something you weren't aware of.

Waiting is the hardest part.

Let's go back to before you've had to do this worrying... and waiting.

You've just started your search for coverage and you are comparing term life quotes. The premium has to be within your budget. Ads online and commercials on television are pitching this thing called "guaranteed acceptance" life insurance. "You cannot be turned down." "No medical exam." Well, sounds good. The premiums? You can do a lot better.

Continue your search and you find an independent life and health agent licensed in your state. Being independent means this agent has access to many products from the top insurers.

The agent informs you that before you go to all the trouble of completing and submitting an application, and ordering a medical exam, and then waiting for an answer, take 5 minutes to complete a Health Analyzer.

The agent assures you this is NOT an application for insurance and you are under no obligation. The results from the health analyzer could save you money, and waiting.

Here's what the agent needs to know:

Height and weight?

Tobacco use?

Has your father, mother, sister or brother been diagnosed with cancer or cardiovascular disease?

High blood pressure (hypertension)?

Had speeding tickets or DUIs?

Been diagnosed or received treatment for sleep apnea, diabetes, Parkinson's, kidney disease, etc.?

Been declined for insurance coverage in the past?

With your honest and accurate answers to the above, your agent can find which carriers are most likely to approve coverage. While you are still on the phone. No waiting.

A number of insurers use accelerated underwriting. The idea is to streamline the process so you can get the coverage quicker. If you are applying for coverage of less than $500,000 to a $1,000,000 and you have no major health issues, you may not need a medical exam. You may not need to wait!

Your agent can then take a brief application and submit to the insurer of your choice. Within 24 - 48 hours the insurer will be in touch with you to verify and get more information.

You work directly with the insurer.

You get a final answer in a few business days.

Keep in mind you may need that medical exam if you are applying for a larger amount of coverage or you have certain medical conditions.

I'll tell how to ace that exam in Part 2.

You've just completed and submitted your application for term life insurance. And now you wait to hear if you have been approved for coverage. Just as with anything in our lives, acceptance makes us feel we are part of something, having more value. Rejection hurts.

While you are waiting, you begin to wonder if anything could go wrong: Did the agent get all the information and submit to the insurer in good order? Delays and more waiting will result from an application missing information. Did you forget something that might have an impact on the insurer's decision? Results of that medical exam you had to take could show something you weren't aware of.

Waiting is the hardest part.

Let's go back to before you've had to do this worrying... and waiting.

You've just started your search for coverage and you are comparing term life quotes. The premium has to be within your budget. Ads online and commercials on television are pitching this thing called "guaranteed acceptance" life insurance. "You cannot be turned down." "No medical exam." Well, sounds good. The premiums? You can do a lot better.

Continue your search and you find an independent life and health agent licensed in your state. Being independent means this agent has access to many products from the top insurers.

The agent informs you that before you go to all the trouble of completing and submitting an application, and ordering a medical exam, and then waiting for an answer, take 5 minutes to complete a Health Analyzer.

|

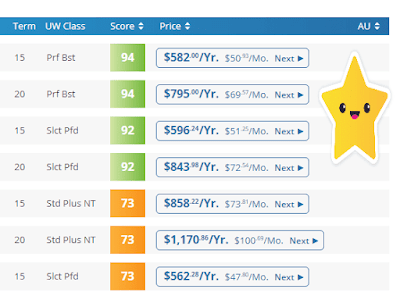

| Comparing premiums of multiple insurers. |

The agent assures you this is NOT an application for insurance and you are under no obligation. The results from the health analyzer could save you money, and waiting.

Here's what the agent needs to know:

Height and weight?

Tobacco use?

Has your father, mother, sister or brother been diagnosed with cancer or cardiovascular disease?

High blood pressure (hypertension)?

Had speeding tickets or DUIs?

Been diagnosed or received treatment for sleep apnea, diabetes, Parkinson's, kidney disease, etc.?

Been declined for insurance coverage in the past?

With your honest and accurate answers to the above, your agent can find which carriers are most likely to approve coverage. While you are still on the phone. No waiting.

A number of insurers use accelerated underwriting. The idea is to streamline the process so you can get the coverage quicker. If you are applying for coverage of less than $500,000 to a $1,000,000 and you have no major health issues, you may not need a medical exam. You may not need to wait!

Your agent can then take a brief application and submit to the insurer of your choice. Within 24 - 48 hours the insurer will be in touch with you to verify and get more information.

You work directly with the insurer.

You get a final answer in a few business days.

Keep in mind you may need that medical exam if you are applying for a larger amount of coverage or you have certain medical conditions.

I'll tell how to ace that exam in Part 2.

Comments

Post a Comment