What the Experts Say: A Few Reasons to Have Term Life Insurance

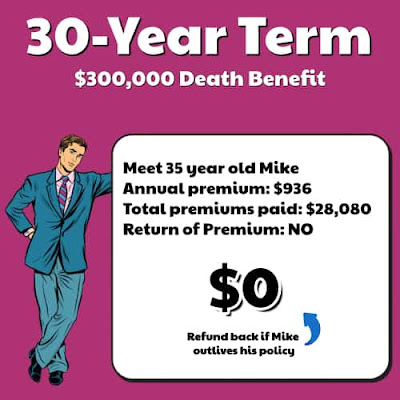

You can trust in what experts say about a subject - as long as you understand your own personal situation is unique and that no single solution fits all. Let's take the subject of having term life insurance . Financial experts such as: Dave Ramsey, Suze Orman, and Clark Howard have weighed in on the matter of having term life vs. whole life and other life insurance products. Consider the purchase of term life by asking these questions: - What are the main reasons to buy any insurance? - How much insurance should I buy? - When should I buy insurance? The answers can address more than one question. That's good! It makes things simpler. Give me a reason to buy term life. 1. You got married. You have had an addition to the family. You bought a new house with a mortgage attached. They are really all the same reason: you've had a "life event" and now your life has changed. You need to protect those changes. 2. Term Life is more affordable and eas...