Get You Money Back, Guaranteed.

Get Your Money Back If You Never Use it.

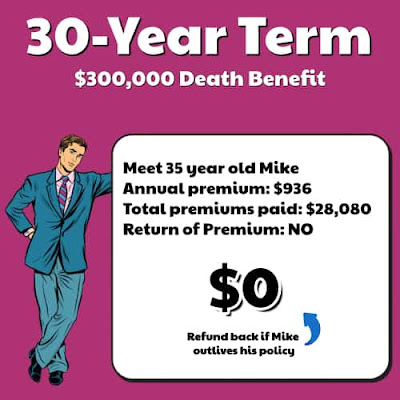

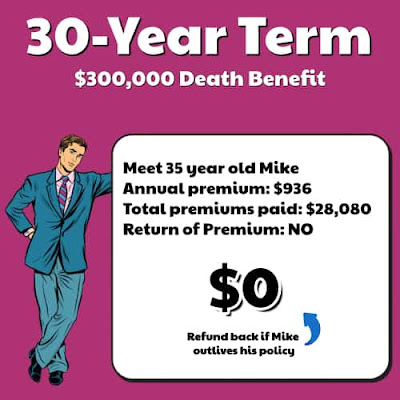

Mike is a 35 year-old who just bought his second home. He's married, has a great wife and 3 children, ages 9, 7, and 2. That new home is going to provide them much satisfaction and great memories in the future. Right now, Mike sees it as a 30-year, $300,000 responsibility he wants to protect as well as the wife and kids.

The group insurance Mike has through his employer is not enough to cover his entire mortgage and he's looking for additional insurance on his own. He's heard about Return of Premium insurance and is considering this option.

The group insurance Mike has through his employer is not enough to cover his entire mortgage and he's looking for additional insurance on his own. He's heard about Return of Premium insurance and is considering this option.

Mike is building his 401k at work and is following other retirement strategies. Does this Return of Premium work into his retirement picture?

Insurance companies began offering return-of-premium riders on their term policies in the early 1990s as a solution to the "live-and-lose" dilemma presented by traditional term policies. As the name implies, this rider will allow a policyholders to recover all or part of their premiums paid over the life of the policy if they do not die during the stated term. This effectively reduces their net cost to zero if a death benefit is not paid.

An independent life and health agent explained there are two catches with adding this rider to a policy: 1. Mike must keep the policy in force that is, pay premiums for the entire term or else he loses the benefit, and 2. premiums will be higher with the Return of Premium rider.... as much as 40% higher!

Mike asked his agent if ROP term life should be considered in his overall investment strategy.

There are many "experts" who will crunch the numbers and dazzle with a specific return on investment that the ROP rider feature provides. But Mike's agent answered "NO" to Mike's direct question: ROP term life insurance is not an investment.

There are many "experts" who will crunch the numbers and dazzle with a specific return on investment that the ROP rider feature provides. But Mike's agent answered "NO" to Mike's direct question: ROP term life insurance is not an investment.

The agent did offer to Mike an explanation for choosing ROP term in a series of questions:

What do you want this coverage to do for you?

You can also view a return of premium policy as a forced savings vehicle. If you aren’t great with money and want to make sure you have something saved up later in life, an ROP term life insurance policy provides you protection for 20 or 30 years, and at the end of it you’re rewarded with the money you put into the policy.

So if Mike is good with money and his investments, ROP may not be for him.

Can you budget the added premium?

It makes no sense to have something if you can't afford to keep it. Remember, if the policy is canceled, there are no premiums refunded. It only works if you keep the policy in force for the entire term. Mike has to ask himself if he's in this for the long haul.

What happens if you die, Mike?

If the policy is in force, Mike's beneficiary will receive the full death benefit. Some insurance carriers also return the premiums paid in to that point in time.

What happens if you live, Mike?

Congratulations! 😁 You've kept the policy paid and now you may have a new house, a new mortgage with just a few years of payments left. Here's what Mike can do:

- Pay off the remaining mortgage balance which would save interest costs.

- Take the payoff and buy a single premium life insurance policy which he will never have to pay another dime on.

- Take the payoff and add it to his existing investments. Mike should note the payoff is tax-free.

Mike and his family have a lot to think about before they decide on new term life insurance coverage. Now he has the questions he needs to answer to make a smart decision.

Mike is a 35 year-old who just bought his second home. He's married, has a great wife and 3 children, ages 9, 7, and 2. That new home is going to provide them much satisfaction and great memories in the future. Right now, Mike sees it as a 30-year, $300,000 responsibility he wants to protect as well as the wife and kids.

The group insurance Mike has through his employer is not enough to cover his entire mortgage and he's looking for additional insurance on his own. He's heard about Return of Premium insurance and is considering this option.

The group insurance Mike has through his employer is not enough to cover his entire mortgage and he's looking for additional insurance on his own. He's heard about Return of Premium insurance and is considering this option.Mike is building his 401k at work and is following other retirement strategies. Does this Return of Premium work into his retirement picture?

Insurance companies began offering return-of-premium riders on their term policies in the early 1990s as a solution to the "live-and-lose" dilemma presented by traditional term policies. As the name implies, this rider will allow a policyholders to recover all or part of their premiums paid over the life of the policy if they do not die during the stated term. This effectively reduces their net cost to zero if a death benefit is not paid.

An independent life and health agent explained there are two catches with adding this rider to a policy: 1. Mike must keep the policy in force that is, pay premiums for the entire term or else he loses the benefit, and 2. premiums will be higher with the Return of Premium rider.... as much as 40% higher!

Mike asked his agent if ROP term life should be considered in his overall investment strategy.

There are many "experts" who will crunch the numbers and dazzle with a specific return on investment that the ROP rider feature provides. But Mike's agent answered "NO" to Mike's direct question: ROP term life insurance is not an investment.

There are many "experts" who will crunch the numbers and dazzle with a specific return on investment that the ROP rider feature provides. But Mike's agent answered "NO" to Mike's direct question: ROP term life insurance is not an investment.The agent did offer to Mike an explanation for choosing ROP term in a series of questions:

What do you want this coverage to do for you?

You can also view a return of premium policy as a forced savings vehicle. If you aren’t great with money and want to make sure you have something saved up later in life, an ROP term life insurance policy provides you protection for 20 or 30 years, and at the end of it you’re rewarded with the money you put into the policy.

So if Mike is good with money and his investments, ROP may not be for him.

Can you budget the added premium?

It makes no sense to have something if you can't afford to keep it. Remember, if the policy is canceled, there are no premiums refunded. It only works if you keep the policy in force for the entire term. Mike has to ask himself if he's in this for the long haul.

What happens if you die, Mike?

If the policy is in force, Mike's beneficiary will receive the full death benefit. Some insurance carriers also return the premiums paid in to that point in time.

What happens if you live, Mike?

Congratulations! 😁 You've kept the policy paid and now you may have a new house, a new mortgage with just a few years of payments left. Here's what Mike can do:

- Pay off the remaining mortgage balance which would save interest costs.

- Take the payoff and buy a single premium life insurance policy which he will never have to pay another dime on.

- Take the payoff and add it to his existing investments. Mike should note the payoff is tax-free.

Mike and his family have a lot to think about before they decide on new term life insurance coverage. Now he has the questions he needs to answer to make a smart decision.

Comments

Post a Comment